are dental implants tax deductible 2021

A lot of people find that getting a dental implant is one of the best things that they can do for. Tax laws vary by country as all laws do.

Dental Implants Cost Types Benefits More Carecredit

You can make HSA contributions in 2021 if you have an HSA-eligible health insurance policy with a deductible of at least 1400 for single coverage or 2800 for family.

. SB 5008 Chapter 226 Laws of 2021 Cash and Trade Discounts. Are Dental Implants Income Tax Deductible. Remember though that your itemized deductions for.

The good news is that will include all of your medical and dental expenses not just your dental implants. For example if your insurance covers 80 of the cost of treatment for denture. 502 Medical and Dental Expenses.

Taxes on your gross income are deductible by 5. The sales tax deduction continues to be available for 2021 for taxpayers itemizing deductions. The Medical Expense Tax Credit METC is a non-refundable tax credit that you can use to reduce the tax that you paid or may have to pay.

22 2022 Published 512 am. While the interest deduction is indeed suspended. Are Dental Implants Tax Deductible 2021.

There is a small catch though. A tax deduction is allowed as long as the amount subtracted is reduced by the amount claimed as a deduction for federal income tax purposes. Yes if they are not merely cosmetic and the dentist has recommended them as treatment for your dental condition.

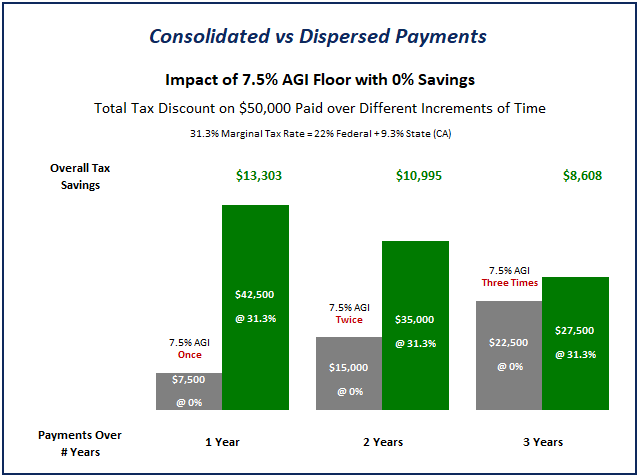

You can only deduct expenses greater than 75 of. Of course your medical expenses plus your other itemized deductions still have to exceed your standard deduction before you will see a difference in your tax due or refund. 22 2022 published 512 am.

If youre wondering whether cosmetic surgery dental implants LASIK or other medical expenses are tax deductible the IRS has a. Yes the dental implant is a medical expense deductible as an itemized deduction on Schedule A. 22 2022 published 512 am.

Deductible Cost Dental Floss Dental. However for 2021 your deduction for state and local income taxes sales taxes and property. If you itemize your deductions for a taxable year on Schedule A Form 1040 Itemized Deductions you may be able to deduct.

The amount of the discount may be deducted from. Employers providing long term care benefits to. This BO tax deduction applies to health and welfare organizations.

Only the expense that you paid with out of pocket funds is deductible. With the passage of the Tax Cuts and Jobs Act of 2017 in December the fate of HELOC tax deductions became uncertain. To help you with this cost the canada revenue agency allows dental expenses to be used as medical.

8 Best Ways To Afford Dental Implants For Missing Teeth Sloan Creek Dental

Is Invisalign Tax Deductible Dr Hall Media Center

Ways To Pay For Dental Implants Hagerstown Dentist

What Dental Work Is Tax Deductible

Dental Implant Live Patient Program Itc Seminars

3 Irs Dental Implant Discount Plans Tax Deductible Savings

Section 179 Tax Deductions For Dentists Savings Dental Equipment

3 Irs Dental Implant Discount Plans Tax Deductible Savings

Which Dental Expenses Are Considered Deductible Medical Expenses When Filing Income Taxes 2022 Turbotax Canada Tips

5 Dental Implant Grants In Minnesota Grants For Medical

Dental Implant Cost Near Me Clear Choice Cost Maryland

Does Medicaid Cover Dental Implants Grants For Medical

Dental Implant Cost Near Me Clear Choice Cost Maryland

Implants Dental Insurance Medi Cal Medicare Hsa

Are Dental Implants Tax Deductible Atlanta Dental Implants

Domestic Dental Implant Live Patient Program Itc Seminars

3 Irs Dental Implant Discount Plans Tax Deductible Savings

Frisco Tx Invisalign Cost Frisco How Much Are Invisalign Clear Aligners 2021 Highland Oak Dental

All On 4 Implants Solution Indianapolis Oral Surgery Dental Implant Center