flow through entity llc

An entity is considered a flow-through entity if it is treated as tax transparent in the jurisdiction it was created which we understand to mean. As a result only the individuals not the business are taxed.

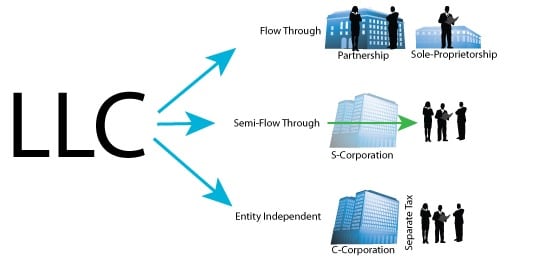

An LLC can choose between different tax treatments.

. The model rules refer to flow-through entities. LLC flow-through is a business structure that passes the profits losses credits and expenses to the owners of the company. Flow-Through Entity Tax.

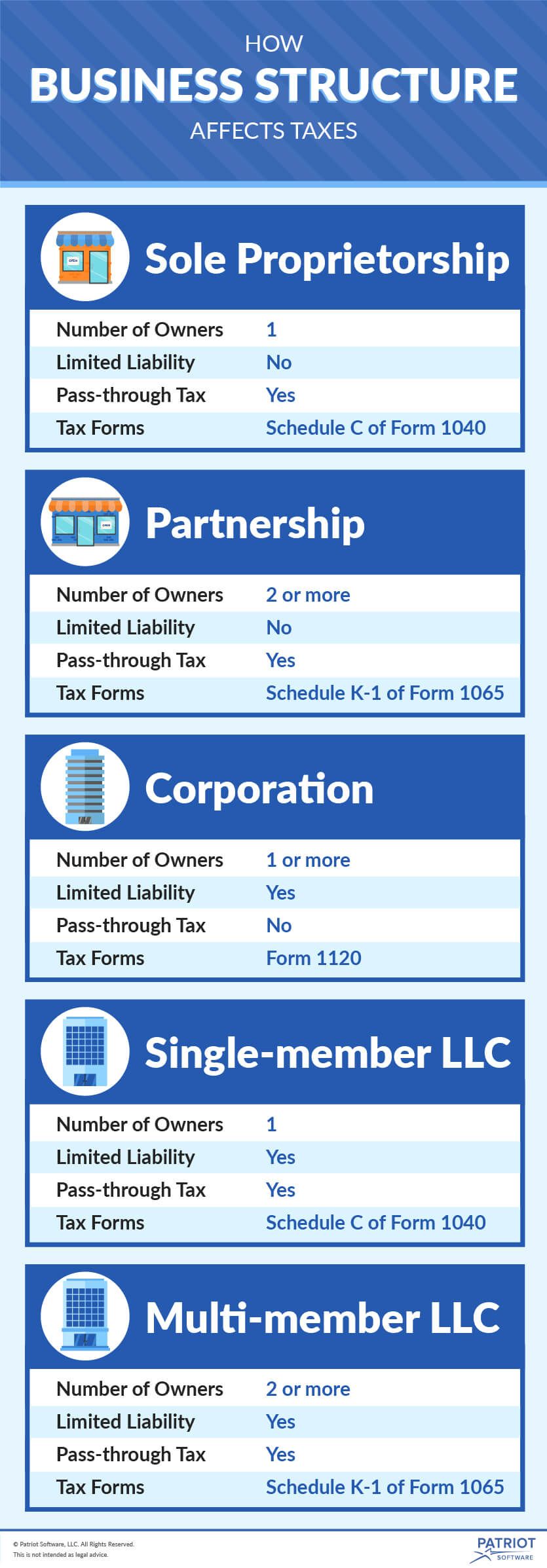

They can choose to adopt the tax regime of sole proprietorships partnerships S corporations or C corporations. The protection of personal. LLC Income Tax Overview.

However the late filing of 2021 FTE returns. Thus the income is taxed only once. With the proliferation of new forms of hybrid entities such as LLCs LLPs and LLLPs.

This guidance is expected to be published in early January 2022 and will be posted to the Departments website. Under proposed regulations an LLC. An LLC that chooses to be taxed in this way will have its.

While the default tax treatment for an LLC is pass-through taxation owners may elect to be taxed as C corporations. Flow-through entities are different from C corporations they are subjected to single taxation and not double taxation. Effective January 1 2021 the Michigan flow-through entity FTE tax is levied on certain electing entities with business activity in Michigan.

An LLC is considered a pass-through entityalso called a flow-through entitywhich means it pays taxes through an individual income tax code rather than through a. A flow-through entity passes through its earned income directly to the shareholders or partners. A flow-through entity is also called a pass-through entity.

With that said the LLC isnt a separate tax entity. Is elected and levied on the Michigan portion of the. This means that when a company is unable to pay a debt the personal property of the LLC members such as homes and cars are shielded from the creditor.

Flow-through entities are common businesses to. That is the income of the entity is treated as the income of the investors or owners. 2021 Flow-Through Entity FTE annual return payments must be made timely to avoid penalty and interest.

A flow-through entity is a business in which income is passed straight to its shareholders owners or investors. For further questions please contact the Business Taxes Division. Are Partnerships LLPs LLCs and SMLLCs Treated as Flow Through Entities for State Tax Purposes.

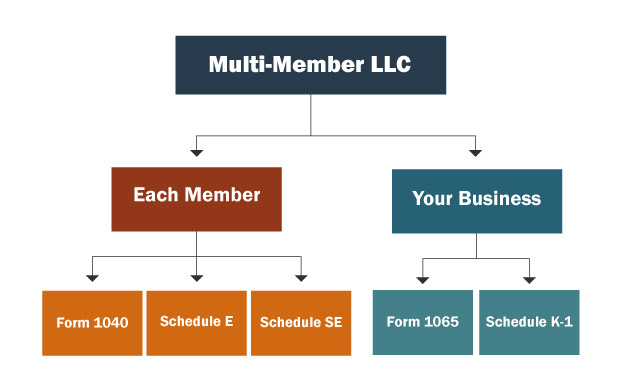

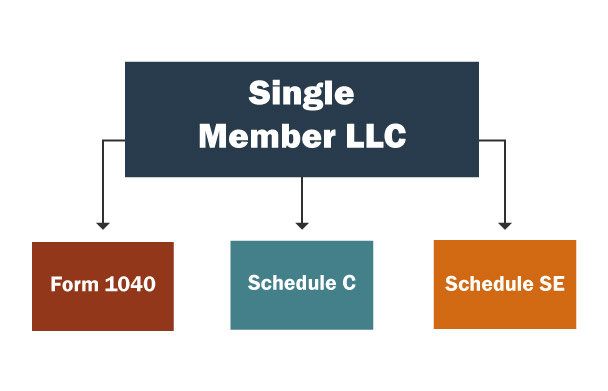

A flow-through entity FTE is a legal entity where income flows through to investors or owners. A pass-through entity allows a lot of flexibility because LLC owners can choose how their business will be taxed and still retain the benefits of a flow-through entity. LLCs with only one owner single-member LLCs or SMLLCs are sole-proprietorships for tax purposes with income and expenses flowing through to Schedule C of the members personal.

Therefore LLC owners cant be held personally liable for the debts and obligations of the business.

What Are Pass Through Businesses Tax Policy Center

Which Entity Fits Your Business Structure Llc S Corps And More

C Corp Vs S Corp Partnership Proprietorship And Llc Toptal

What S The Best Type Of Business Entity For Tax Purposes Kdp Llp

Elective Pass Through Entity Tax Wolters Kluwer

Llc Taxes How Is An Llc Taxed Truic

How To Form An Llc Advantages Disadvantages Wolters Kluwer

Pass Through Entity Tax 101 Baker Tilly

Pass Through Business Income And 2018 Tax Reform Doe Ticker Tape

Business Entity Tax Basics How Business Structure Affects Taxes

Llc Taxes How Is An Llc Taxed Truic

Pass Through Taxation What Small Business Owners Need To Know

What Are The Types Of Business Entities Legal Entity Management Articles

What Is A Pass Through Entity Youtube

What Is A Passthrough Entity Universal Cpa Review

Pass Through Entity Definition Examples Advantages Disadvantages